Working Capital

Working Capital

Welcome to Bizonics Working Capital Services

Running a business in India can be exciting but also challenging, right? One big thing you need to keep your business going strong is working capital. Don’t worry if it sounds complicated – we’re here to explain it simply and show how Bizonics can help your business thrive!

What is Working Capital?

Working capital is the money you have to run your business every day. It’s like the cash you use to pay for things like raw materials, salaries, or shop rent. You find it by taking your current assets (cash, inventory, or money customers owe you) and subtracting your current liabilities (like loans or bills due within a year).

For example, if your business has ₹10 lakh in assets and ₹6 lakh in liabilities, your working capital is ₹4 lakh. This is the money that keeps your business moving smoothly.

Why Working Capital is Important

In India, where markets are fast and competition is tough, working capital is like oxygen for your business. Here’s why it matters:

Pay on Time

You can clear supplier bills, employee salaries, or GST payments without stress.

Handle Sudden Costs

Need to repair machinery or stock up for Diwali sales? Working capital helps.

Grow Your Business

Want to open a new shop or launch an online store? You need cash to make it happen.

Impress Banks

Good working capital shows banks and investors that your business is solid, making loans easier to get.

Without enough working capital, even a successful business, like a busy saree shop or a growing masala brand, can face trouble. That’s where Bizonics steps in.

Common Working Capital Problems in India

Managing cash in India isn’t always easy. Many businesses face issues like:

Delayed Payments

Customers or distributors often take months to pay, slowing your cash flow.

Too Much Stock

Storing extra goods, like electronics or clothes, locks up your money.

Unexpected Costs

Festivals or supply chain issues can create sudden expenses.

Confusing Finances

Not tracking cash properly makes it hard to plan for GST or loan repayments.

Does this sound like your business? Don’t worry – Bizonics knows these challenges and has solutions that work for Indian businesses.

How Bizonics Can Help Your Business

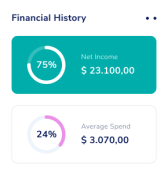

Check Your Cash Flow

We study how money moves in and out of your business to find ways to save.

Manage Inventory

We help you stock just enough goods, so your money isn’t stuck in godowns.

Faster Payments

We find ways to get customers to pay quicker and negotiate better terms with suppliers.

Find Loans

Need extra cash? We guide you to the right bank loans or schemes like Mudra or MSME loans.

Plan Finances

We give tips to manage taxes, plan budgets, and grow your profits.

Whether you run a small kirana store or a big manufacturing unit, we tailor our services to fit your needs. We listen to your problems and goals to make sure our solutions work for you.

Why Choose Bizonics?

Working with us can change how your business runs. Here’s what you get:

More Cash

Always have money ready for daily needs or new opportunities.

Less Tension

No more worrying about unpaid bills or loan EMIs.

Smoother Operations

Save money with better processes, like smarter inventory or billing.

Faster Growth

Use extra cash to expand, like starting a website or entering new markets.

Relax

Focus on selling or creating while we handle your finances.

Our Simple Approach

We’re like your business’s best friend. First, we sit with you to understand your finances – your sales, expenses, and debts. This helps us spot where your cash is getting stuck. Then, we make a clear plan to free up money and keep your business healthy.

We don’t just give you a plan and leave. Our team works with you to put it into action. We guide you step by step and even train your staff to manage cash better. We check in regularly to make sure everything is going well.

Do You Need Our Help?

Not sure if your business has working capital problems? Look out for these signs:

- You’re always low on cash for daily expenses.

- You struggle to pay suppliers or EMIs on time.

- You have too many goods in stock, like unsold kurtas or electronics.

- Customers take 60-90 days to pay you.

- You can’t grow because you don’t have enough money.

If any of these sound familiar, let’s have a chat. Bizonics can help you fix these issues.

Let’s Talk Today

Ready to make your business stronger and grow faster? Contact Bizonics for a free consultation. Whether you’re in Ahmedabad, Anand, Nadiad, Bharuch, Surat or anywhere in India, we’re here to help your business succeed.